Foundational Stages of Digital Lending in Southeast Asia

About this Report

In Momentum Works’, “Foundational Stages of Digital Lending in Southeast Asia” report, we analyzed Southeast Asia’s digital lending landscape. The report provides a broad overview of the fintech infrastructure in Southeast Asia, the accelerators of growth, as well as the challenges ahead. Furthermore, it presents opportunities the region possesses in terms of digital lending as well as a brief comparison between the different players.

Report Outline

- Southeast Asia’s digital lending landscape is far behind developed countries

- Excluding Singapore, countries in SEA have a very low level of digital lending

- The main reason for this is low banking penetration

- And this happens due to a lack of funds, documentation, and infrastructure

- However, fast smartphone penetration seems to offer a window of opportunity

- Banking penetration is still the number one driver behind digital payments

- Enabling digital payments is therefore the key to enabling digital lending

- Targeting the right market segment is critical for success

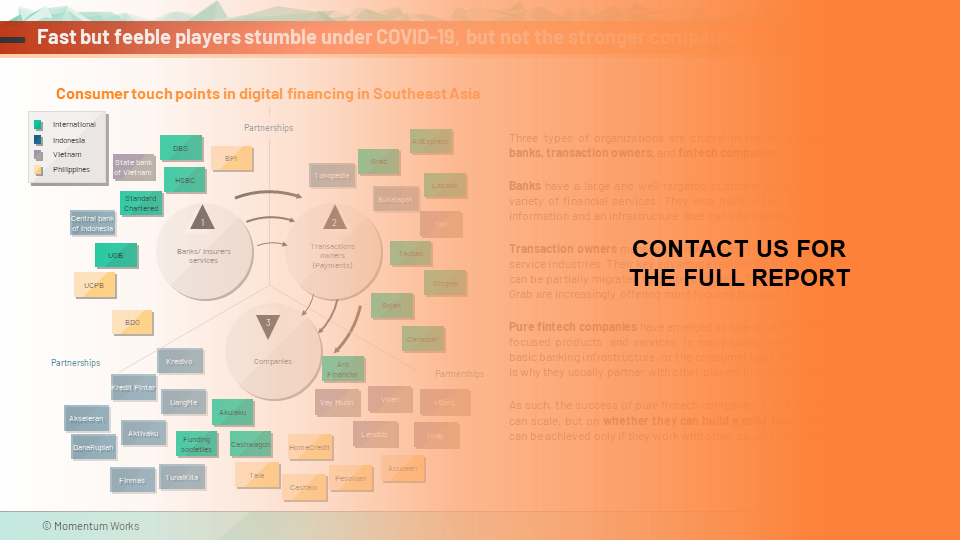

- Fast but feeble players stumble under COVID-19, but not the stronger companies

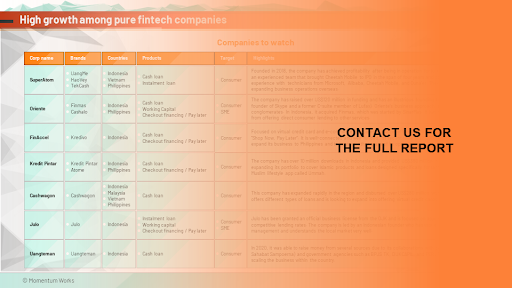

- High growth among pure fintech companies

- A fast shift to profitability

- Different players cope differently with the region’s challenges

- High profitability cannot be achieved without technology

- Fintech companies will thrive when the road is paved

- Fintech companies will need to have a clear value proposition to succeed

![[Press Release] Southeast Asia’s food delivery spend reached US$17.1B with Vietnam achieving the highest growth](https://i0.wp.com/thelowdown.momentum.asia/wp-content/uploads/2024/01/Food-delivery-platforms-in-Southeast-Asia-2024-_MW_Jan-2024-2.jpg?resize=218%2C150&ssl=1)

![[New Report] Food delivery platforms in Southeast Asia (SEA) 4.0](https://i0.wp.com/thelowdown.momentum.asia/wp-content/uploads/2024/01/Food-delivery-platforms-in-Southeast-Asia-2024-_MW_Jan-2024-2.jpg?resize=100%2C70&ssl=1)

![[New report] Southeast Asia spends US$3.4 billion on modern coffee in 2023](https://i0.wp.com/thelowdown.momentum.asia/wp-content/uploads/2023/11/Coffee-in-Southeast-Asia_MW_Nov-2023-1.png?resize=100%2C70&ssl=1)

![[New report] Apples to Apples 3.0: Benchmarking major tech platforms – what’s next after achieving profitability?](https://i0.wp.com/thelowdown.momentum.asia/wp-content/uploads/2023/09/Apples-to-Apples-3.0_benchmarking-major-tech-platforms_whats-next-after-profitability_MW_Sept-2023-7.jpg?resize=100%2C70&ssl=1)