Menjamur: the race to digitise 65M small businesses in Indonesia

Micro, Small, and Medium Enterprises

The sector that employs 97% of Indonesian workforce

MSMEs constitute 99.9% of all businesses in Indonesia and in 2019 they generated US$ 0.7T revenue, according to the Ministry of Cooperatives and SMEs of the Republic of Indonesia.

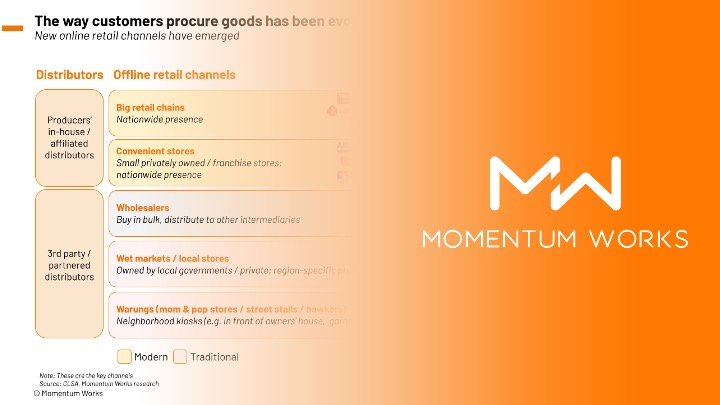

We have seen many startups looking to “digitize/enable/empower” the more than 64 million micro, small and medium enterprises (MSMEs) in Indonesia.

However, are these startups/business models sustainable and monetisable?

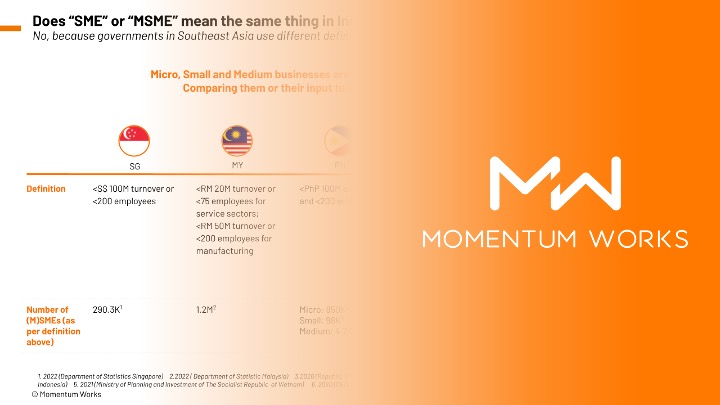

Moreover, are there really 65 million MSMEs as people claim? What do these MSMEs look like?

We cover these questions from industry stakeholders and international investors in our new report ‘Menjamur: the race to digitise 65M small businesses in Indonesia; Which business model will prevail?’

The report provides in-depth analyses of the MSME numbers and insights into the business dynamics behind the players who aim to digitise MSMEs.

List of contents:

- Introduction

- Landscape of MSMEs in Indonesia: MSMEs in numbers

- Challenges & opportunities for MSMEs

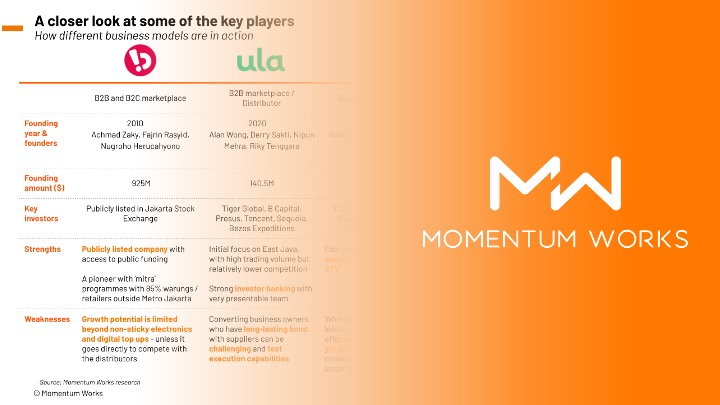

- Key players: which business models will prevail?

- Conclusion & perspective

Players featured: Bukalapak, TaniHub, Sayurbox, Aruna, Ula, SUPER, Gudangada, SIRCLO, Shopee, Tokopedia, Grab, Gojek, Mekari, FORSTOK, Desty, JUBELIO, iSeller, Lummo, BukuWarung, CrediBook, Modalku, Amartha, FAZZFINANCIAL

![[New Report] Food delivery platforms in Southeast Asia (SEA) 4.0](https://i0.wp.com/thelowdown.momentum.asia/wp-content/uploads/2024/01/Food-delivery-platforms-in-Southeast-Asia-2024-_MW_Jan-2024-2.jpg?resize=100%2C70&ssl=1)

![[New report] Southeast Asia spends US$3.4 billion on modern coffee in 2023](https://i0.wp.com/thelowdown.momentum.asia/wp-content/uploads/2023/11/Coffee-in-Southeast-Asia_MW_Nov-2023-1.png?resize=100%2C70&ssl=1)

![[New report] Apples to Apples 3.0: Benchmarking major tech platforms – what’s next after achieving profitability?](https://i0.wp.com/thelowdown.momentum.asia/wp-content/uploads/2023/09/Apples-to-Apples-3.0_benchmarking-major-tech-platforms_whats-next-after-profitability_MW_Sept-2023-7.jpg?resize=100%2C70&ssl=1)