Live commerce in Southeast Asia

Live commerce GMV in China has grown at a CAGR of more than 146%. In 2021, the GMV of live commerce in China was twice the total ecommerce GMV in Southeast Asia. Can live commerce’s success in China be replicated in Southeast Asia? Could it be the next big thing here?

In Momentum Works’ “Live commerce in Southeast Asia” report, we covered the following key questions from industry stakeholders and international investors:

- Market logic and evolution: How did the live commerce industry evolve in Southeast Asia? What stage is it currently in?

- The ecosystem in Southeast Asia vs China: What are the differences? Can China’s success be replicated (or adapted) in Southeast Asia?

- Key players: Who are the key players in Southeast Asia? What value do they add to the ecosystem? What are the limitations of each platform?

- Future and challenges: What are the challenges platforms, multichannel networks (MCNs) and hosts, as well as suppliers face? Is there a future for the industry in Southeast Asia? How can it develop further?

Platforms covered: Facebook, Shopee, TikTok, Douyin, Taobao, Wechat, Shopline, Avana, Upmesh.

List of contents

- Industry Overview

- What is live commerce?

- Why live commerce?

- The history of live commerce in China and Southeast Asia

- Developed live commerce ecosystem in China

- The live commerce ecosystem map in China

- GMV of China ecommerce, China live commerce, and SEA ecommerce

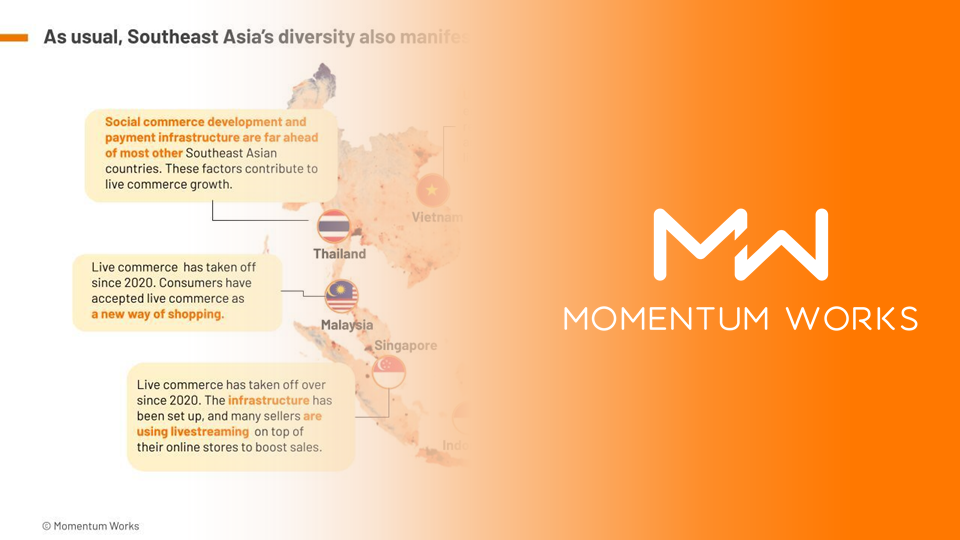

- Where are we in Southeast Asia

- The live commerce ecosystem map in Southeast Asia

- Key differences between China and Southeast Asia

- Key players in Southeast Asia

- Different strategies of key players and their approach to live commerce

- Strengths and challenges of key players

- Enablers

- Why is there a need for enablers?

- Conclusions and perspectives

- Future paths and challenges for the market and players

![[New Report] Food delivery platforms in Southeast Asia (SEA) 4.0](https://i0.wp.com/thelowdown.momentum.asia/wp-content/uploads/2024/01/Food-delivery-platforms-in-Southeast-Asia-2024-_MW_Jan-2024-2.jpg?resize=100%2C70&ssl=1)

![[New report] Southeast Asia spends US$3.4 billion on modern coffee in 2023](https://i0.wp.com/thelowdown.momentum.asia/wp-content/uploads/2023/11/Coffee-in-Southeast-Asia_MW_Nov-2023-1.png?resize=100%2C70&ssl=1)

![[New report] Apples to Apples 3.0: Benchmarking major tech platforms – what’s next after achieving profitability?](https://i0.wp.com/thelowdown.momentum.asia/wp-content/uploads/2023/09/Apples-to-Apples-3.0_benchmarking-major-tech-platforms_whats-next-after-profitability_MW_Sept-2023-7.jpg?resize=100%2C70&ssl=1)