Digital Banks in Malaysia

Landscape and prospect – for international investors and decision makers

About the report

The Central Bank of Malaysia (Bank Negara Malaysia) has closed the digital bank application process in July 2021. 29 contenders (mostly in consortia) applied, for up to 5 licences.

Banks, industry conglomerates, big tech players, ecommerce operators, fintech players, cooperatives and state governments are among the applicants. The results will be announced in Q1 2022.

With that, following Rise of Digital banks in Indonesia report, Momentum Works launched second report of Digital banks in Southeast Asia series – Digital banks in Malaysia, to answer fundamental questions from international inventors and key decision makers:

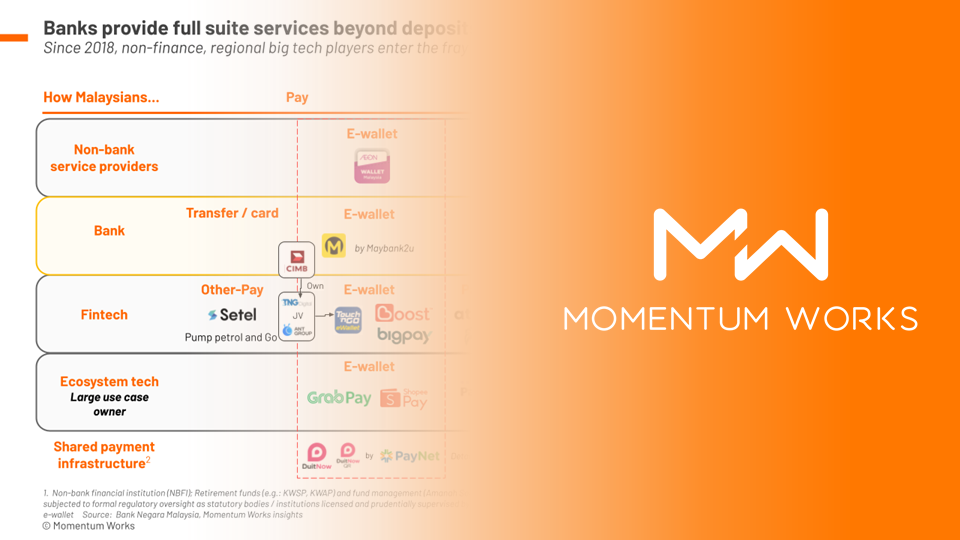

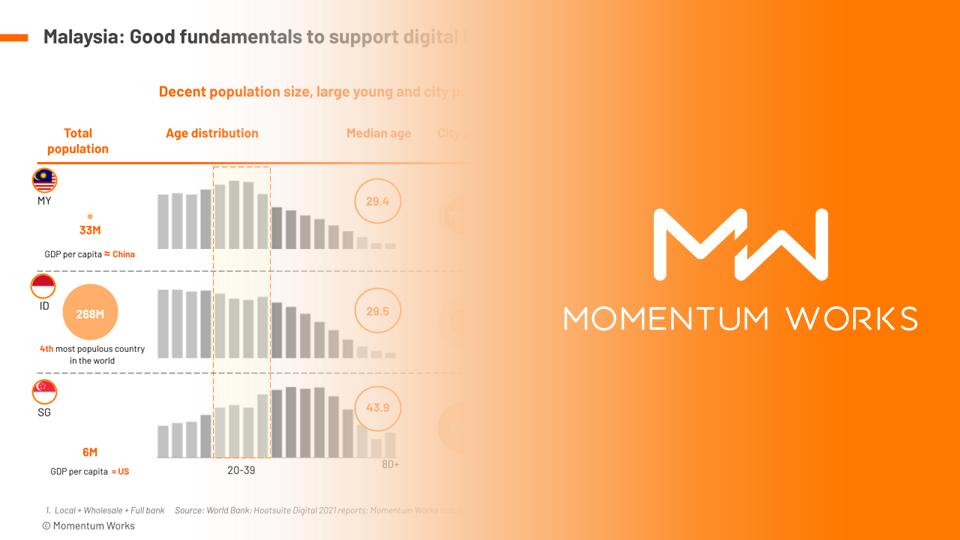

- How are the banking and financial landscape like in Malaysia?

- What are the prospects of digital banks – at the back of existing banks and fintech players?

- Which are the potential areas for digital bank disruptions in Malaysia and how does it differ from neighbouring countries in Southeast Asia?

- What do regulators (Bank Negara Malaysia) look for?

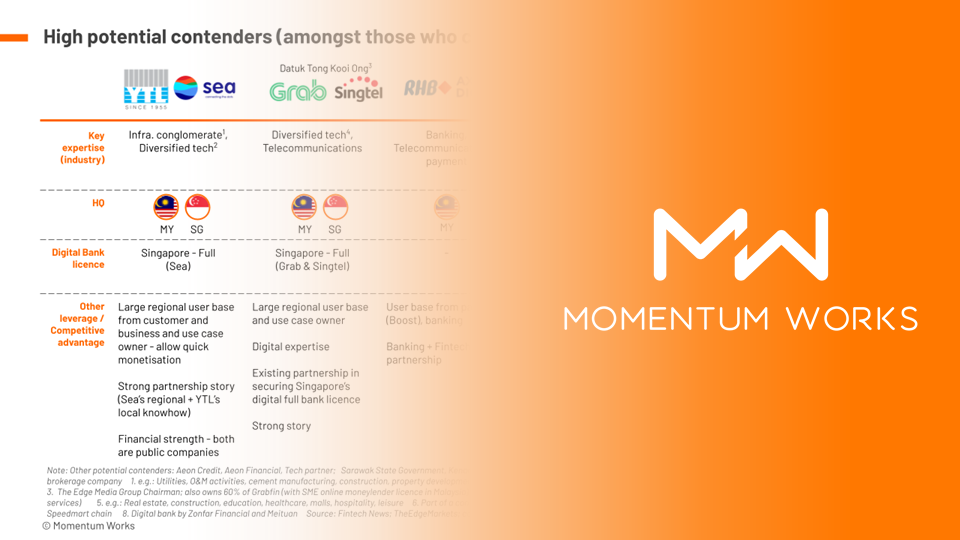

- Who are the key contenders for Malaysia digital bank license?

List of contents

- Introduction

- Background & opportunity

- Digital bank development

- Policies & regulations

- Malaysia digital bank contenders

- Conclusion & perspectives

![[New Report] Food delivery platforms in Southeast Asia (SEA) 4.0](https://i0.wp.com/thelowdown.momentum.asia/wp-content/uploads/2024/01/Food-delivery-platforms-in-Southeast-Asia-2024-_MW_Jan-2024-2.jpg?resize=100%2C70&ssl=1)

![[New report] Southeast Asia spends US$3.4 billion on modern coffee in 2023](https://i0.wp.com/thelowdown.momentum.asia/wp-content/uploads/2023/11/Coffee-in-Southeast-Asia_MW_Nov-2023-1.png?resize=100%2C70&ssl=1)

![[New report] Apples to Apples 3.0: Benchmarking major tech platforms – what’s next after achieving profitability?](https://i0.wp.com/thelowdown.momentum.asia/wp-content/uploads/2023/09/Apples-to-Apples-3.0_benchmarking-major-tech-platforms_whats-next-after-profitability_MW_Sept-2023-7.jpg?resize=100%2C70&ssl=1)